-

Financial Wellness Strategies

Financial Strategies

Registered Accounts

Registered Accounts -

Personal

Banking

Borrowing

-

Business

-

About Us

About UsAbout Your CU

Contact Us

Governance

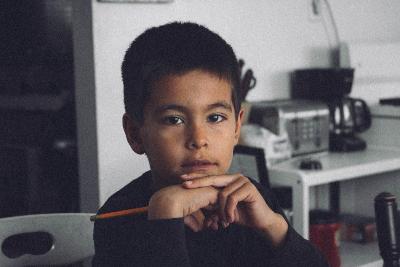

It's Never too Early to Talk Money

A University of Cambridge study found that money habits in children are formed by the time they are seven years old so it is never too early to talk to your kids about money. Kids obviously learn differently at different ages so here is a brief evolution of money education for children.

Pre-schoolers and Kindergartners

Show them that stuff costs money

Even at a very young age it is valuable to let your children transact a purchase. Take them to the Store and let them physically hand money to the cashier. This simple action will have more impact than a five-minute explanation.

Elementary Students

The Power of money

Start by giving them control over a bit of money. This can be for task around the home like making their bed or walking the dog. Encourage them to explore other ways to make money by providing a service to others. Step two is even more important and that is splitting this money up to meet different wants and desires. Some for saving for long term, other for immediate purchases like a treat, and still other for long term objectives like new shoes or the latest video game. This is the precursor to a budget.

Resist the impulse

This age group really knows how to capitalize on the impulse buy—especially when it uses someone else’s money. Instead of giving in, let your child know they can use their hard-earned money to pay for it. Encourage comparison shopping and waiting at least a day before they purchase anything over $15. It will likely still be there tomorrow, and they’ll be able to make that money decision with a level head the next day.

Teenagers

Talk about credit

As soon as your kid turns 18, they’ll get hounded by credit card offers. If you haven’t taught them why debt is a bad idea, they’ll become yet another credit card victim. Remember, it’s up to you to determine the right time you’ll teach them these principles.

Make them budget Appy

Every teen of this generation lives on their smart phone. Once you establish an account for them, have them download the money management app from their financial institution. Go through it with them and use it to establish a budget that they can track via the app.

Become a Financial Genius with Brilliant Advice from Your Credit Union. For more information on the benefits of banking with a credit union call: 1-800-379-7757.

Contact Us

So many ways to get the help you need!